News

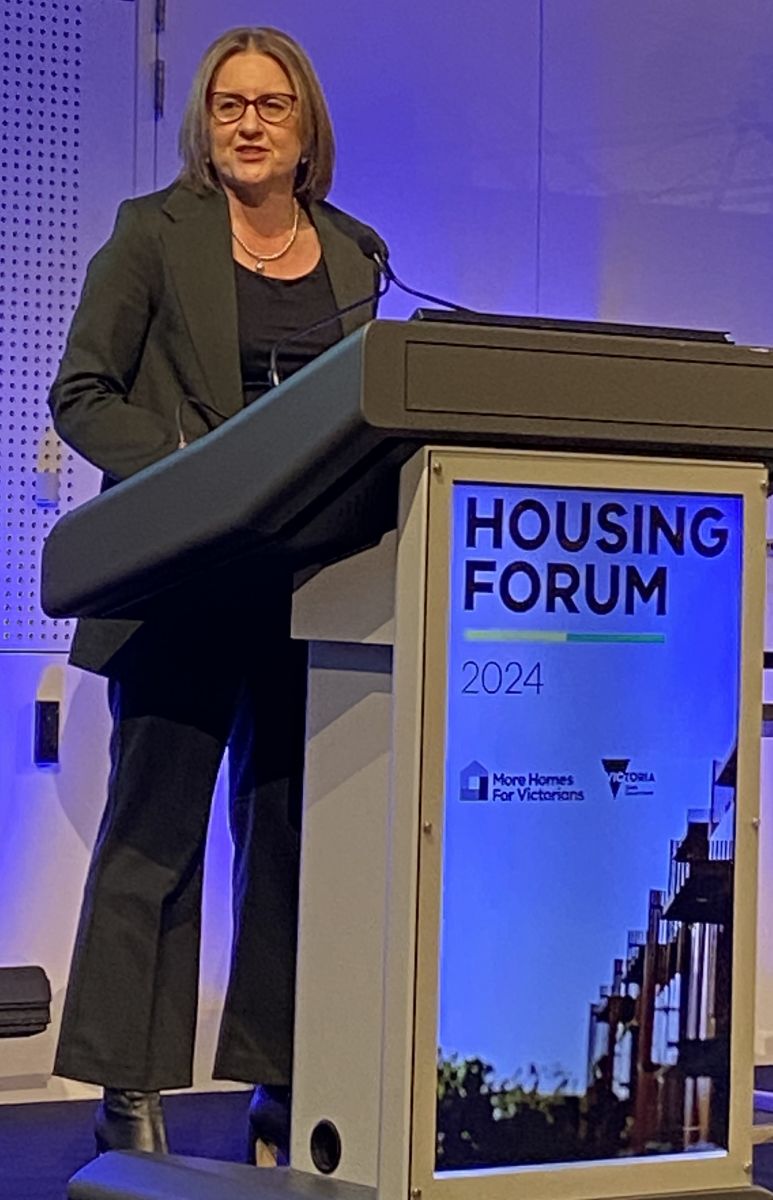

2024 Victorian Housing Forum

At today’s Victorian Housing Forum, Premier Jacinta Allen, Treasurer Tim Pallas and industry representatives discussed the pressing issues facing Victoria’s housing market. Over the past 30 years, the median house price in Melbourne has surged from 3.5 times the average income to 7 times, highlighting a critical need for policy intervention. Homelessness continues to be a stark indicator of policy gaps that require immediate attention. The panellists emphasised that the current housing system is unsustainable and inequitable, with rising interest rates and construction costs presenting significant headwinds. As Melbourne's population is projected to reach 9 million by 2051, there is a clear need to rethink urban planning and housing strategies.

Victorian Economic Growth and Fiscal Strategy

Victoria’s economy has grown by 9.1% over the past two years, with expectations to outpace the national average in the coming five years. Goods and services exports have risen by 17%, and Victoria leads the nation in construction activity, with 10,000 more homes completed than in New South Wales. Despite this, concerns were raised about Victoria’s housing statement lacking detailed cost analysis. The state’s debt is currently 7% of the revenue base, with investments focused on growing the economy and job creation. A fiscal repair strategy aims to stabilise and reduce debt while maintaining economic momentum.

Infrastructure Investment and Urban Development

Victoria invested $24 billion in new infrastructure in the last fiscal year. However, there is now a recognition that centrally funded infrastructure spending needs to slow, with a shift towards refining planning processes, opening government-owned land, and setting housing targets near jobs, transport, and services. The Suburban Rail Loop (SRL) is set to drive more development of townhouses, mid-rise, and high-rise buildings within walking distance of stations. Over the past 30 years, greenfield developments have played a crucial role in supporting the economy, but the strategy is evolving to balance growth while meeting housing aspirations.

Industry Challenges and Regulatory Reform

The Property Council of Australia highlighted that despite economic growth, housing stock remains 19% below the 10-year average, calling for incentives in the next budget. Developers face a high tax burden, reaching up to 40%, which exacerbates affordability issues. Streamlining development approvals and creating certainty in taxation policy are crucial. Developers and investors need a stable environment to commit to long-term projects, with a push for better town planning and facilitation. The panel also emphasized the need for innovative models like Build-to-Rent (BTR) and Build-to-Sell (BTS) to attract long-term capital.

Building Consumer Confidence and Future Growth

Restoring consumer confidence in the quality and safety of housing, particularly in the apartment sector, is essential. There is a growing recognition that apartments (Class 2) are the future, and industry performance must improve to meet these demands. The forum underscored the importance of maintaining community connections and managing growth sustainably. Major infrastructure projects are seen as catalysts for private investment, but the current system's unsustainability and inequity need addressing. As Victoria looks towards 2050, the strategy must balance growth, sustainability, and affordability, with a focus on innovative solutions and regulatory reform to meet the needs of its evolving population.

More News

Game-Changer for Outer Suburbs: NGAA Celebrates Suburban University Study Hubs Announcement

28 . 11 . 2024 Read morePopulation Boom & Gloom: Infrastructure Funding Fails Fastest Growing Communities

22 . 11 . 2024Announcement from NGAA Chair Cr Deeth

26 . 09 . 2024Announcement from NGAA Chair Cr Deeth, Deputy Mayor Wollondilly Shire Council.

Read moreThe Case for a Unified Urban Policy: Insights from Bronwen Clark at UDIA WA

04 . 09 . 2024Recently our CEO, Bronwen Clark, was invited to speak at the Urban Development Institute of Australia Western Australia (UDIA WA) event in Perth. Themed A Shared Vision for Urban Growth in our Cities: Understanding the Draft National Urban Policy and What It Means for Perth, this event brought together 200 WA town planners and developers from the private and public sectors.

Read more